The transportation management system (TMS) platform has come a long way over the past decade — from a key differentiator for some transportation and logistics companies to a must-have for all.

According to market research firm Grand View Partners, the global market size for TMS platforms was estimated at $61.2 billion in 2018. With a compounded annual growth rate of 16.7%, the forecast is for the market size to cross the $100 billion mark over the next few years.

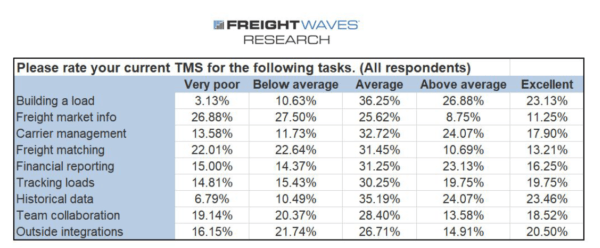

The key mover for the TMS market is how much room there is for improvement. Based on FreightWaves’ TMS brand awareness survey, many users believe their current TMS needs quite a bit of improvement. Beyond improvement though, another positive is the growth in new users. The brand awareness survey shows that 6.8% of respondents do not use a TMS. Other surveys, including a 2018 CarrierLists survey of fleets running between five and 50 trucks, showed that only 30% use a TMS.

Source: FreightWaves TMS brand awareness survey - August 2020

These market dynamics have opened the floodgates for new entrants to enter the TMS market. These include newly formed bootstrapped and venture capital-backed technology companies to established transportation and logistics companies spinning off proprietary TMS technology as separate business units.

Another key mover of the TMS market is the cloud computing movement. Cloud technology has lowered the entry barriers for new entrants to develop software as a service (SaaS) platforms that are affordable for transportation and logistics companies of all sizes.

This should be music to the ears of TMS brands and investors. If 70% of small fleets are not using a TMS software to manage their businesses, then the opportunities are immense for new user adoption.

The major challenge for capturing this growing market for all TMS brands is standing out in a crowded field — a point that is driven home by FreightWaves’ TMS brand awareness survey. With new entrants racing into an already crowded TMS market, it will become ever more difficult for both established and new TMS brands to stand out in the crowd.

This will not be an easy task. Standing out from the crowd will need a two-pronged plan. The first is focusing on continuous improvement of the product itself. This will include advancements in freight market intelligence, carrier management tools and freight-matching technology. Whether these are built internally or as part of integrations with partners is up to the TMS provider to decide.

The second prong is a coherent marketing strategy. This begins with defining a target market. Only with a target market can the product team focus on what enhancements and iterations to design and build. Once this is accomplished, the focus then shifts to developing go-to-market strategies. Far too often FreightTech companies with outstanding products fail because their marketing messages are filled with technical jargon that focuses squarely on the features. Features do not sell. Benefits surrounded by compelling narrative do.

Like in all other industries, the winners of the TMS race will be the ones that not only build a superior market but can communicate these benefits to the market.

Where does the TMS market stand today? Who are the major players? Who has the best brand awareness? And most importantly, what are the opportunities and challenges for the TMS market going forward?

These answers are the focus of this FreightWaves white paper on brand awareness and innovation for the TMS market. It centers around the results of a FreightWaves survey that was emailed to newsletter subscribers in August. The survey had 162 respondents and the results are presented below.

Members Only

You have selected content that's only available to members of FreightWaves Passport. As a member, you gain immediate access to the most in-depth and informative freight research available. It's your gateway to continuing education.

Members also get:

- Access to exclusive community dedicated to discussing the most important challenges facing freight.

- Monthly and Quarterly Freight Market reports keeping you informed of industry trends.

- Much, much more!

Click below to learn more and sign up today!

Subscribe

Existing Passport subscribers may log in using the form below.